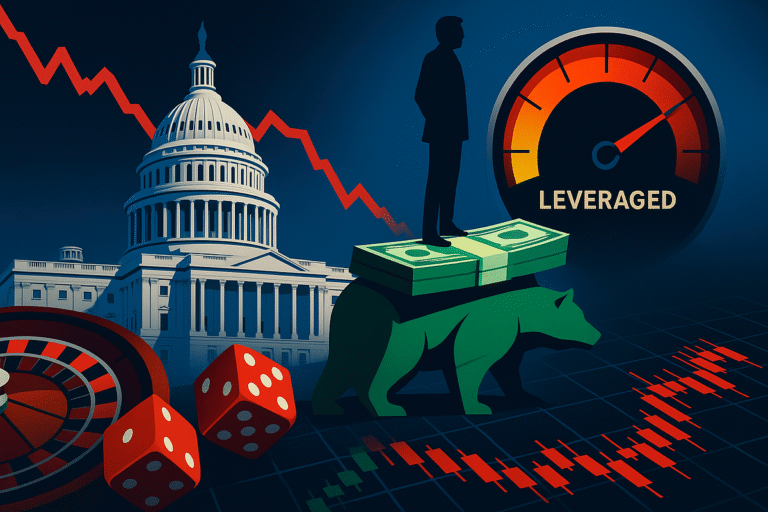

Representative Tim Moore recently made waves by purchasing up to $380,000 worth of TZA, a triple leveraged bear ETF that profits when small cap stocks decline. After four decades in this business, I’ve seen plenty of these high stakes bets against the market. Some pay off spectacularly, others blow up just as dramatically.

For context, Tim Moore serves North Carolina’s 14th district and sits on the House Financial Services Committee, giving him regular exposure to economic and financial market discussions. Like all members of Congress, his trades must be publicly disclosed, which is how this position became visible to market watchers.

Although Tim may hold privileged information about current market conditions due to his position in Congress, I still think this trade is quite risky. Let me walk you through what this trade means, whether it makes sense, and what regular investors can learn from it.

What TZA actually does to your money

TZA is the Direxion Daily Small Cap Bear 3X Shares ETF. It’s designed to move three times in the opposite direction of the Russell 2000 small cap index on a daily basis. If small caps drop 2% in a day, TZA should rise about 6%. If small caps rise 2%, TZA falls about 6%.

That 3x leverage cuts both ways with mathematical precision. It amplifies gains when you’re right, but it amplifies losses when you’re wrong. I’ve watched too many investors get seduced by the potential for quick profits without fully understanding the downside risks.

The daily rebalancing mechanism also creates what’s called volatility decay over longer periods. Even if small caps end up exactly where they started after a volatile month, TZA holders often lose money due to the compounding effects of daily leverage resets.

The case for betting against small caps right now

There are legitimate reasons someone might bet against small cap stocks in late 2025. Small companies are typically more sensitive to economic headwinds than large caps. They have less access to capital, weaker balance sheets, and fewer resources to weather storms.

Interest rate environments particularly hurt small caps. Many smaller companies depend on debt financing for growth, and higher rates squeeze both their funding costs and their customers’ spending power. If you believe rates will stay elevated or economic growth will slow, small caps become vulnerable.

Small caps also tend to be more domestically focused than large multinational corporations. If you’re concerned about U.S. economic conditions specifically, betting against small caps rather than the broader market makes tactical sense.

From a valuation perspective, small caps haven’t participated as much in the recent market rally. But sometimes that’s because the market is correctly pricing in their higher risks and lower profitability.

The case against this leveraged bet

The arguments against this trade are equally compelling. First, the leverage makes this extremely dangerous. Even if you’re ultimately right about small cap direction, the daily volatility can wipe you out before your thesis plays out.

I remember a client in 2009 who bought a similar leveraged bear ETF, convinced the market would keep falling. He was wrong about the timing by just a few weeks, and the subsequent rally cost him 60% of his position before he finally threw in the towel.

Small caps have historically shown periods of outperformance, but this hasn’t been consistent over all long-term periods. Recent decades have seen large caps frequently outperform, particularly during technology-driven bull markets.

The current small cap market shows signs of potential value. The Russell 2000 has underperformed the S&P 500 significantly in recent years. Sometimes that underperformance sets up for strong relative performance when sentiment shifts, but I do not think that will be the case for the Russell 2000 in the near future.

Lessons from four decades of market cycles

In my experience, leveraged bear bets hardly ever work. The mathematical drag of daily rebalancing makes them unsuitable for buy and hold strategies, and timing market crashes with daily or weekly precision is a nearly impossible task.

I’ve seen very few of these trades succeed. The 2008 financial crisis, the dot com crash, and other sharp downturns rewarded bear market bets handsomely. But the timing had to be nearly perfect.

The failures were more common and often more dramatic. Investors would identify real problems in the market or economy, but their timing would be off by months or quarters. The leverage would amplify their losses during the interim rallies.

One client made substantial profits shorting financial stocks in 2007, then gave it all back and more by staying short too long in 2009. The lesson: even when you’re right about the big picture, execution and timing matter enormously with leveraged products.

Better ways to hedge portfolio risk

For most investors, there are less risky ways to hedge against market declines than triple leveraged bear ETFs. Traditional portfolio diversification, modest put option positions, or simply raising cash levels can provide downside protection without the extreme risks.

Government bonds have historically provided portfolio insurance during stock market declines. Even modest allocations to Treasury bonds can offset some equity losses during market stress without the daily volatility of leveraged products.

Some investors use smaller positions in single leveraged bear ETFs rather than triple leveraged products. The reduced volatility makes them more manageable while still providing downside exposure.

Building a balanced portfolio that can weather different market conditions is usually more effective than trying to time bear market trades. This approach requires understanding how different asset classes behave during various economic cycles and constructing allocations accordingly. In my guide, Investing the Bogle way: A simple guide for the long‑term investor, I show you how to build portfolios that provide natural hedging through diversification rather than relying on complex leveraged products:

What this trade teaches regular investors

Representative Moore’s TZA purchase illustrates both the opportunities and dangers of leveraged investing. If small caps do decline significantly in the near future, this position could generate substantial profits. But if they rally or even move sideways, the losses could be equally substantial.

The trade also highlights the importance of position sizing. Even $380,000 might represent a small percentage of a larger portfolio, making it an acceptable speculation rather than a dangerous “bet the farm” strategy.

For most individual investors, this type of trade falls into the speculation category rather than investment. If you can afford to lose the entire position and it won’t affect your long term financial security, leveraged bear ETFs might have a place in a small corner of your portfolio.

But they should never become core holdings or represent significant percentages of your investable assets. The mathematical realities of daily leverage resets and volatility decay make them unsuitable for most traditional investment strategies.

The key lesson is understanding the difference between investing and speculating, and making sure you’re comfortable with both the potential gains and the likely losses before putting real money at risk.